The global textile industry is experiencing a fundamental shift in sourcing strategies as traditional offshore manufacturing models face unprecedented challenges from supply chain disruptions, geopolitical tensions, and sustainability requirements. Near sourcing in textiles has emerged as a strategic response that prioritizes proximity, agility, and resilience over pure cost optimization. This transformation is particularly evident in the rapid development of Africa and Eastern Europe as key textile sourcing destinations, reshaping global apparel sourcing strategies and redefining supply chain resilience for the fashion industry.

The Strategic Imperative for Near Sourcing

The evolution toward near sourcing in textiles represents a fundamental recalibration of global manufacturing strategies that have defined the industry for decades. Traditional offshore manufacturing concentrated in Asia has become increasingly vulnerable to disruptions that extend far beyond cost considerations to encompass risk management, sustainability compliance, and market responsiveness requirements.

Supply chain disruptions resulting from the COVID-19 pandemic demonstrated the fragility of extended global supply chains that prioritized cost efficiency over resilience. Fashion companies discovered that their ability to respond to market changes was severely constrained by lead times that could extend several months and production capacity concentrated in distant regions. These experiences catalyzed a strategic reassessment that elevated proximity and flexibility as critical competitive advantages.

Geopolitical tensions have introduced additional uncertainty into traditional sourcing relationships, with trade wars, tariff changes, and diplomatic conflicts creating unpredictable cost structures and supply availability. The implementation of various trade restrictions and the potential for future policy changes have made geographic diversification a risk management necessity rather than an optional strategy.

Consumer expectations for faster delivery times and more frequent product updates have created market pressures that favor shorter supply chains and more responsive manufacturing networks. The rise of fast fashion and on-demand manufacturing models requires production capabilities that can respond to trend changes within weeks rather than months, making near sourcing in textiles increasingly attractive.

Sustainability regulations and corporate responsibility commitments are driving companies to reduce the carbon footprint of their supply chains while improving visibility into manufacturing practices. Transportation represents a significant component of textile environmental impact, making shorter shipping distances an important factor in achieving carbon reduction targets.

The cost advantages that historically favored offshore production are diminishing as labor costs in traditional manufacturing hubs increase while automation reduces the labor intensity of textile production. This economic evolution makes near sourcing more competitive on pure cost grounds while delivering additional benefits in terms of flexibility and risk reduction.

Africa’s Emergence as a Textile Manufacturing Hub

The African continent is experiencing rapid development as a textile manufacturing destination, driven by abundant labor resources, preferential trade agreements, and growing investment in manufacturing infrastructure. Several African countries have emerged as particularly attractive near sourcing destinations for European and American fashion companies seeking alternatives to Asian production.

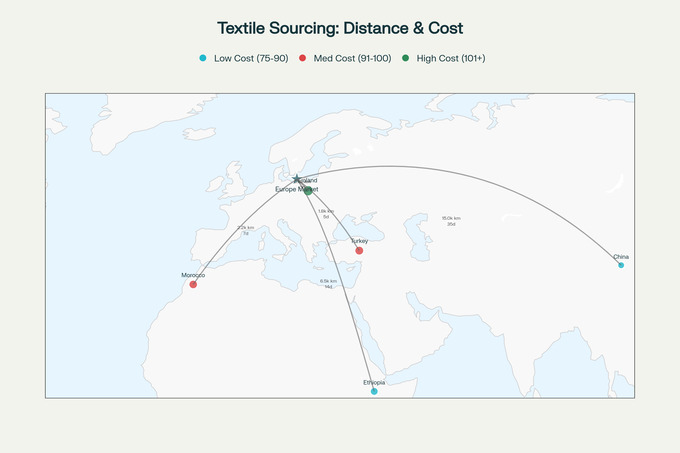

Ethiopia has positioned itself as a leading textile manufacturing hub through significant government investment in industrial parks and infrastructure development. The country offers substantial cost advantages with competitive labor rates while maintaining reasonable proximity to European markets. Major international brands including H&M, Zara, and PVH Corp have established manufacturing partnerships in Ethiopia, attracted by the combination of cost efficiency and market access benefits.

The Ethiopian government has created dedicated textile and garment industrial parks with modern infrastructure, reliable power supply, and streamlined regulatory processes designed to attract international investment. These facilities provide the scale and efficiency necessary to compete with established manufacturing hubs while offering the flexibility and responsiveness that near sourcing strategies require.

Egypt represents another significant opportunity in African textile manufacturing, leveraging its strategic location between Europe, Africa, and Asia to serve multiple markets efficiently. The country has a well-established textile industry with sophisticated manufacturing capabilities and experienced workforce that can handle complex production requirements. Egypt’s proximity to European markets provides significant logistical advantages while maintaining competitive cost structures.

The Qualifying Industrial Zones program and various trade agreements provide preferential access to US and European markets, creating additional economic incentives for brands to source from Egypt. These trade benefits can offset higher labor costs compared to some Asian alternatives while providing supply chain benefits that justify the transition.

Morocco has developed particular strength in serving European markets due to its geographic proximity and established trade relationships. The country offers sophisticated manufacturing capabilities with relatively short lead times to major European fashion centers. Morocco’s textile industry has evolved to focus on higher-value products and more complex manufacturing processes that command premium pricing while maintaining competitive cost structures.

The integration of sustainable manufacturing practices and certifications has become a competitive advantage for African textile producers seeking to attract brands with strong sustainability commitments. Many African manufacturers are investing in renewable energy, water recycling, and waste reduction systems that align with corporate sustainability goals while reducing operational costs.

Eastern Europe’s Strategic Manufacturing Renaissance

Eastern Europe has experienced a renaissance in textile manufacturing as brands seek alternatives to Asian production that offer European proximity with competitive cost structures. The region combines skilled manufacturing expertise, modern infrastructure, and regulatory alignment with European Union standards to create an attractive near sourcing environment.

Poland has emerged as a significant textile manufacturing hub, leveraging its central European location and skilled workforce to serve major fashion brands efficiently. The country offers sophisticated manufacturing capabilities with the ability to handle complex technical textiles and high-quality fashion products. Poland’s membership in the European Union provides regulatory certainty and eliminates trade barriers that can complicate sourcing from non-EU countries.

The development of digital manufacturing technologies and automation systems in Polish textile facilities has enabled competitive cost structures while maintaining high quality standards. These technological investments allow Polish manufacturers to compete effectively with lower-cost alternatives while providing the flexibility and responsiveness that near sourcing strategies require.

Romania represents another key Eastern European textile destination, offering competitive manufacturing costs with European Union market access and regulatory compliance. The country has substantial experience in textile manufacturing with a skilled workforce capable of handling diverse product categories and quality requirements.

Romanian textile manufacturers have invested significantly in sustainable manufacturing technologies and certifications, positioning themselves to serve brands with strong environmental commitments. These investments include water recycling systems, renewable energy adoption, and waste reduction programs that align with corporate sustainability goals while reducing operational costs.

Turkey occupies a unique position as a bridge between European and Asian markets while offering sophisticated textile manufacturing capabilities. The country has developed particular expertise in technical textiles, home textiles, and fashion products that require high-quality manufacturing standards. Turkey’s proximity to European markets provides significant logistical advantages while maintaining competitive cost structures compared to Western European alternatives.

The Turkish textile industry has embraced advanced manufacturing technologies including automated production systems, digital printing, and sustainable processing methods that enable competitive positioning against both Asian and European alternatives. These technological capabilities allow Turkish manufacturers to offer shorter lead times and greater flexibility while maintaining cost competitiveness.

Bulgaria and the Czech Republic represent emerging opportunities in Eastern European textile manufacturing, offering competitive cost structures with European Union market access and skilled manufacturing workforces. These countries are attracting investment from international brands seeking to diversify their sourcing base while maintaining proximity to European markets.

Supply Chain Resilience and Risk Management

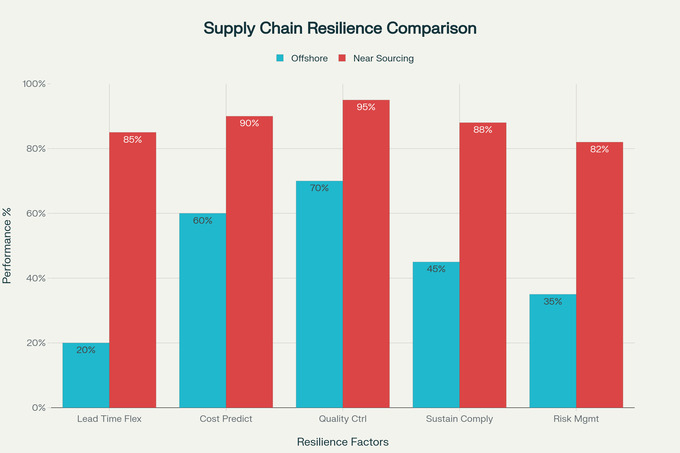

The transition toward near sourcing in textiles reflects a broader evolution in supply chain strategy that prioritizes resilience and risk management alongside traditional cost optimization objectives. This strategic shift recognizes that supply chain disruptions can impose costs that far exceed the savings achieved through pure cost-based sourcing decisions.

Diversification strategies enabled by near sourcing reduce concentration risk that has historically made fashion companies vulnerable to disruptions in specific regions or countries. By developing manufacturing capabilities in multiple near sourcing destinations, companies can maintain production continuity even when individual locations experience disruptions.

The shorter transportation distances associated with near sourcing reduce exposure to shipping disruptions, port congestion, and international logistics complications that can delay product delivery and increase costs. These logistics benefits become particularly valuable during peak shipping seasons or when global transportation networks experience capacity constraints.

Quality control and compliance monitoring become more manageable with near sourcing arrangements due to reduced travel time and cultural barriers. Companies can conduct more frequent facility inspections, implement real-time monitoring systems, and maintain closer relationships with manufacturing partners when geographic proximity enables regular interaction.

Inventory management benefits from near sourcing include reduced safety stock requirements, faster replenishment cycles, and improved demand forecasting accuracy. These operational improvements can substantially reduce working capital requirements while improving customer service levels through better product availability.

The ability to respond quickly to market changes represents a crucial competitive advantage enabled by near sourcing strategies. Fashion companies can adjust production volumes, modify product specifications, and introduce new designs more rapidly when manufacturing partners are located in proximity to key markets.

Technology Integration and Digital Manufacturing

The development of near sourcing capabilities in Africa and Eastern Europe has been accelerated by the adoption of advanced manufacturing technologies that enable competitive positioning against established offshore alternatives. Digital manufacturing systems, automation technologies, and sustainable production methods are creating new possibilities for efficient, high-quality textile production in near sourcing destinations.

Digital sampling and virtual design technologies reduce the time and cost associated with product development while enabling more effective collaboration between brands and manufacturers. These systems allow design iterations to be completed remotely while ensuring accurate communication of specifications and requirements.

Automated cutting, sewing, and finishing systems are being implemented in near sourcing facilities to achieve labor productivity levels that compete with lower-cost alternatives while maintaining higher quality standards. These automation investments enable manufacturers to offer competitive pricing while providing the flexibility and responsiveness that near sourcing strategies require.

Real-time production monitoring and tracking systems provide visibility into manufacturing progress and quality metrics that enable proactive management of production schedules and quality issues. These systems support the closer collaboration and faster response times that represent key advantages of near sourcing arrangements.

Sustainable manufacturing technologies including waterless dyeing, renewable energy systems, and waste reduction processes are being implemented to meet brand sustainability requirements while reducing operational costs. These technological investments position near sourcing destinations to serve the growing market for sustainable fashion products.

Digital marketplace platforms and sourcing systems are facilitating connections between brands and near sourcing manufacturers while providing tools for specification communication, order management, and quality assurance. These platforms reduce the transaction costs associated with developing new sourcing relationships while providing transparency and accountability throughout the sourcing process.

Economic and Market Dynamics

The economic dynamics supporting near sourcing in textiles reflect fundamental changes in global manufacturing cost structures, trade policies, and market requirements that are reshaping competitive advantages across different sourcing destinations. These economic factors create both opportunities and challenges for brands transitioning toward near sourcing strategies.

Labor cost differentials between traditional offshore destinations and near sourcing alternatives are narrowing as economic development in Asian manufacturing hubs drives wage increases while automation reduces labor intensity in textile production. This convergence makes near sourcing more economically attractive while delivering additional benefits in terms of flexibility and risk reduction.

Transportation cost volatility has increased due to fuel price fluctuations, capacity constraints, and supply chain disruptions that make longer shipping distances more expensive and unpredictable. These cost considerations favor near sourcing arrangements that reduce transportation requirements and provide more predictable logistics costs.

Trade policy uncertainty creates additional economic pressures that favor geographic diversification and near sourcing strategies. Potential tariff changes, trade agreement modifications, and regulatory shifts make supply chain concentration risky while creating incentives for developing alternative sourcing capabilities.

Currency exchange rate volatility can substantially impact the relative cost competitiveness of different sourcing destinations over time. Near sourcing strategies that utilize multiple currencies and geographic regions provide natural hedging against exchange rate fluctuations while reducing financial risk.

The total cost of ownership analysis for sourcing decisions increasingly includes factors beyond direct manufacturing costs, such as inventory carrying costs, quality issues, lead time impacts, and supply chain risk management. When these broader cost considerations are included, near sourcing often demonstrates superior economic performance despite potentially higher direct manufacturing costs.

Sustainability and Environmental Impact

Environmental considerations are becoming increasingly important drivers of near sourcing decisions as brands seek to reduce the carbon footprint of their supply chains while meeting consumer expectations for sustainable products. The environmental benefits of near sourcing extend beyond transportation emissions to encompass broader sustainability improvements throughout the supply chain.

Transportation emissions represent a significant component of textile industry environmental impact, with intercontinental shipping contributing substantially to carbon footprints. Near sourcing in textiles can reduce transportation distances by thousands of miles, resulting in meaningful emissions reductions that support corporate carbon reduction commitments.

The ability to implement more rigorous environmental monitoring and compliance verification becomes feasible with near sourcing arrangements due to reduced geographic barriers and cultural differences. Brands can conduct more frequent facility inspections, implement real-time environmental monitoring systems, and work more closely with manufacturers to achieve sustainability objectives.

Water conservation and wastewater treatment capabilities in near sourcing destinations are often more advanced than those available in some traditional offshore manufacturing locations. This environmental infrastructure enables brands to achieve higher environmental performance standards while meeting increasingly stringent regulatory requirements.

Renewable energy adoption is accelerating in many near sourcing destinations, driven by government policies, cost considerations, and corporate sustainability commitments. These renewable energy investments reduce the carbon intensity of manufacturing while providing long-term cost stability for energy expenses.

Circular economy initiatives including material recycling, waste reduction, and closed-loop manufacturing processes are being implemented more readily in near sourcing facilities due to closer collaboration between brands and manufacturers. These initiatives support sustainability objectives while potentially reducing material costs and waste disposal expenses.

Strategic Implementation and Best Practices

Successful implementation of near sourcing strategies requires careful planning, relationship development, and operational adaptation that extends beyond simple geographic relocation of production. Companies must develop new capabilities, modify existing processes, and create organizational structures that support effective near sourcing operations.

Supplier identification and evaluation processes must be adapted to assess near sourcing alternatives effectively, considering factors such as manufacturing capabilities, quality systems, delivery performance, and sustainability practices. These evaluation criteria may differ substantially from those used for traditional offshore sourcing decisions.

Relationship development and management become more important in near sourcing arrangements due to the closer collaboration and more frequent interaction required to realize the benefits of geographic proximity. Companies must invest in building strong partnerships with near sourcing suppliers while developing communication systems and processes that support effective collaboration.

Operational integration between brands and near sourcing suppliers requires modifications to planning systems, inventory management processes, and quality assurance procedures. These operational changes may require significant investment in systems and training while offering substantial benefits in terms of responsiveness and efficiency.

Risk management frameworks must be adapted to address the specific risks associated with near sourcing arrangements while maintaining appropriate safeguards against supply disruption. These risk management systems should include contingency planning, supplier backup arrangements, and monitoring systems that provide early warning of potential issues.

Performance measurement and continuous improvement processes should be implemented to capture the benefits of near sourcing while identifying opportunities for further optimization. These measurement systems should track not only cost and quality metrics but also sustainability performance, delivery reliability, and flexibility indicators.

The evolution toward near sourcing in textiles represents a strategic transformation that extends far beyond geographic relocation to encompass fundamental changes in supply chain design, supplier relationships, and competitive strategy. As Africa and Eastern Europe continue developing their textile manufacturing capabilities, they offer compelling alternatives to traditional offshore production that deliver enhanced resilience, sustainability, and market responsiveness while maintaining competitive cost structures. Success in this evolving landscape requires sophisticated strategy development, careful implementation, and ongoing optimization that balances multiple objectives while building sustainable competitive advantages.