The textile industry faces unprecedented scrutiny as consumers and regulators demand genuine environmental accountability. While sustainability initiatives have gained widespread adoption, the rise of greenwashing in textile supply chains poses significant risks to brand credibility and undermines authentic progress toward environmental responsibility. This comprehensive analysis examines the true cost of misleading sustainability claims and explores how verified CSR credentials are transforming supplier credibility in fashion sourcing.

The Scope of Greenwashing in Modern Textile Supply Chains

Greenwashing in textile supply chains has evolved into a sophisticated practice that extends far beyond surface-level marketing claims. It often involves selectively highlighting minor environmental improvements while obscuring larger environmental impacts throughout the supply chain.

Reports indicate that many companies create misleading impressions through carefully worded sustainability statements. For example, brands may launch limited “eco-friendly” product lines or emphasize recycling programs that represent only a fraction of their overall operations, thereby projecting an image of sustainability that does not match their broader business models.

The fundamental disconnect lies in promoting circularity and environmental responsibility while simultaneously adhering to production and consumption systems that favor volume-driven sales. This contradiction between messaging and operational reality represents a core challenge in addressing greenwashing in textile supply chains.

Supply chain opacity also enables these practices to persist. Brands may restrict transparency about their sourcing, manufacturing conditions, and raw material origins—making it difficult for consumers, advocacy groups, and buyers to independently verify sustainability claims. Without systemic accountability, misleading representations flourish.

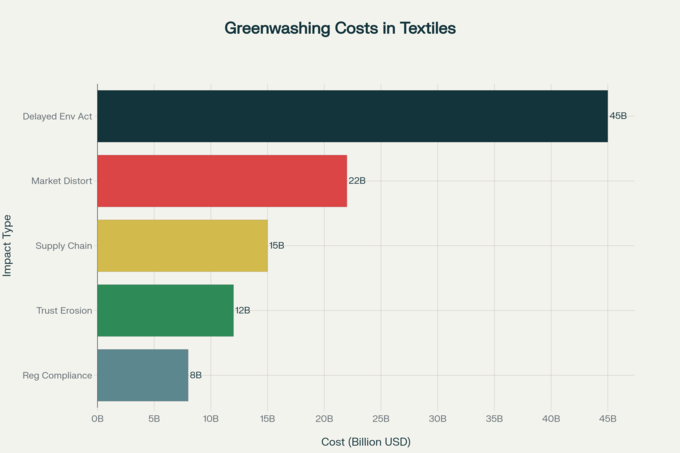

Hidden Environmental and Financial Costs

The true cost of greenwashing extends far beyond immediate consumer deception. Unverified claims erode consumer trust not only in individual companies but in sustainability initiatives as a whole, thereby weakening the credibility of truly responsible manufacturers and suppliers.

Environmental costs compound when greenwashing delays industry-wide reform. The textile sector accounts for approximately six to eight percent of global carbon dioxide emissions, while traditional textile production methods—such as intensive cotton cultivation—require massive water and resource inputs. When misleading sustainability efforts divert attention from genuine reform, opportunities for large-scale environmental improvement are wasted.

Financial risks are emerging as regulatory frameworks shift. The European Union’s Ecodesign for Sustainable Products Regulation and Corporate Sustainability Reporting Directive require verifiable evidence for environmental claims. Companies that rely on superficial sustainability messaging face the prospect of retrofitting their supply chains at significant expense or risking steep compliance penalties.

Greenwashing also distorts competitive dynamics. Suppliers that invest in costly but genuine sustainability measures may find themselves disadvantaged against competitors offering cheaper, less sustainable alternatives that benefit from superficial marketing claims. This misalignment threatens to discourage meaningful environmental investment across the value chain.

The Rise of Verified CSR Credentials

In response, verified Corporate Social Responsibility (CSR) credentials are becoming essential for ensuring authenticity in sustainability claims. Independent and third-party certifications provide credibility by addressing everything from raw material sourcing to labor rights and manufacturing processes.

-

Global Organic Textile Standard (GOTS): Verifies organic status of textiles while covering environmental and social production standards.

-

OEKO-TEX Standard 100: Focuses on consumer safety by testing products for harmful substances.

-

Better Cotton Initiative (BCI): Promotes improved social and environmental practices in cotton cultivation.

-

SA8000 and WRAP: Enforce internationally recognized labor and ethical standards in manufacturing.

-

Cradle to Cradle and LEED Certification: Evaluate material health, recyclability, resource use, and facility-level sustainability.

These certifications provide transparent, audited benchmarks, allowing buyers and consumers to distinguish genuine sustainability leaders from those relying on superficial claims.

Supply Chain Transparency and Traceability Systems

New technologies are further reshaping accountability. Blockchain, digital product passports, IoT sensors, and AI-driven monitoring systems now allow for real-time tracking of raw materials, production conditions, and environmental performance data. This digitalization creates auditable supply chain records and minimizes opportunities for marketing-driven misrepresentation.

Consumer-facing transparency platforms are also emerging, allowing buyers to verify sourcing histories, labor conditions, and environmental impacts directly. This decentralizes accountability and reduces reliance on brand-controlled narratives.

Market Transformation and Competitive Dynamics

With growing scrutiny, competitive advantage is shifting toward suppliers and brands that back claims with verified data and certifications. Procurement decisions increasingly balance cost and delivery with sustainability credentials, while financial markets reward suppliers aligned with Environmental, Social, and Governance (ESG) frameworks.

Meanwhile, educated consumers are demanding stronger accountability, reducing the effectiveness of traditional greenwashing tactics. This creates openings for suppliers that can demonstrate verifiable compliance and authentic sustainability.

Technology-Enabled Verification Solutions

Satellite monitoring, lab testing, mobile applications, and machine learning platforms are expanding the ability to detect inconsistencies and prevent greenwashing. These systems lower verification costs while providing independent, scientific validation of sustainability claims across global supply chains.

Strategic Implications for Industry Stakeholders

Industry stakeholders must adapt to this new accountability-driven landscape:

-

Brands: Require significant investment in transparency systems and verified sustainability to remain competitive.

-

Suppliers: Must align operations with certification requirements to access premium buyers.

-

Investors: Need advanced ESG screening tools to distinguish genuine sustainability from greenwashing.

-

Regulators: Continue to expand enforcement, imposing stricter transparency and reporting laws.

Future Outlook and Industry Evolution

The trajectory away from greenwashing toward verifiable sustainability is accelerating under consumer, regulatory, and market pressures. Certifications and technological verification will become embedded in supply chain management, enabling systemic environmental accountability.

Over the next decade, supply chain partnerships will prioritize verified compliance, longer-term relationships, and collaborative sustainability investment. In this shift, transparency will become both a market expectation and a competitive necessity—ensuring that sustainable leadership is defined by genuine action rather than marketing-driven greenwashing.