Smart and Antimicrobial Textiles for Connected Interiors

Introduction: The Automotive Interior Revolution

The automotive industry stands at a critical inflection point. Vehicle interiors are transitioning from passive, static environments into dynamically intelligent spaces that actively monitor occupant health, adapt to environmental conditions, and respond in real-time to passenger needs. This transformation is fundamentally reshaping interior textile specifications from commodity comfort components into mission-critical health and safety systems. Two converging technological trends are driving this revolution: post-pandemic heightened hygiene awareness elevating antimicrobial protection from luxury feature to baseline specification, and breakthrough innovations in smart textile technology enabling embedded sensors, thermal management, and biometric monitoring directly within fabric structures.

The market opportunity is substantial and immediate. The global antimicrobial textile market reached USD 13.77-15.34 billion in 2025 and is projected to reach USD 16.55-25.51 billion by 2030-2032, expanding at 3.75-7.4% CAGR. More dramatically, the smart textiles market is valued at USD 2.12 billion (2024) and forecast to reach USD 6.42 billion by 2032, exhibiting 14.9% CAGR—nearly 4x faster growth than traditional antimicrobial segments. Within automotive specifically, this nascent market segment currently represents only 3-5% of total antimicrobial textile consumption (approximately USD 1.12 billion), but demonstrates the highest growth trajectory among all application segments.

For textile manufacturers, this convergence represents one of the most significant market opportunities in automotive history. The window for establishing leadership is narrow—major OEMs including BMW, Mercedes-Benz, Tesla, and Toyota are actively developing pilot programs with premium valuations attached to proprietary fabric solutions. Manufacturers who establish early adoption in antimicrobial chemistry, smart sensor integration, and sustainable manufacturing practices will capture disproportionate market share. Those who delay risk commoditization into undifferentiated suppliers competing exclusively on cost.

The Post-Pandemic Hygiene Imperative

The COVID-19 pandemic fundamentally altered consumer and regulatory expectations around vehicle interior textile hygiene. Research indicates 85% of hotel guests cite textile hygiene as a booking factor—a consumer consciousness directly translating to automotive purchasing decisions. Fleet operators (taxi services, car rental companies, autonomous delivery networks) discovered compelling economic logic: contaminated seat fabric requiring deep chemical cleaning ($50-100 per occurrence) versus self-protective antimicrobial surfaces requiring no special maintenance. This economic calculation created market pull for antimicrobial adoption across commercial vehicle segments.

Regulatory evolution reinforced this transition from aspirational to essential. European hospitals mandate ISO 20743 or AATCC 100 antimicrobial compliance; these standards are now migrating into automotive OEM procurement specifications, with leading manufacturers requiring ≥99% bacterial kill rate even after 1,000 abrasion cycles. Mass-transit authorities across Asia-Pacific, Europe, and North America specify antimicrobial requirements for public transportation seat procurement, generating stable demand visibility through multi-year procurement cycles. What was previously marketed as a premium luxury has become a specification baseline—a fundamental market shift driven by converging hygiene awareness, regulatory mandates, and demonstrable economic value.

Advanced Antimicrobial Technologies: From Silver to Breakthrough Systems

Traditional Limitations and Emerging Solutions

Silver nanoparticles dominated early antimicrobial textile development (market share growing from 9% in 2004 to 25% by 2011). Silver’s potency derives from ionic mechanisms disrupting bacterial cell membranes and DNA replication. However, a critical limitation emerged: nanoparticles leach from fabric surfaces during mechanical stress and wash cycles, with up to 80% antimicrobial effectiveness lost after first washing—unacceptable for automotive applications demanding multi-year durability.

Zinc Nanocomposites and Breakthrough Durability

Zinc nanocomposites grown in situ within fabric structures through Crescoating technology represent the performance breakthrough enabling automotive adoption. These systems achieve:

-

99.99-99.9999% bacterial reduction within 24 hours against both Gram-positive (Staphylococcus aureus) and Gram-negative (Klebsiella pneumoniae) bacteria

-

Durability exceeding 100 wash/dry cycles with maintained antimicrobial efficacy (compared to 5-20 cycles for traditional surface coatings)

-

Environmental safety: Zinc is FDA-approved as GRAS (Generally Recognized as Safe) with no documented toxicity

-

Third-party validation: Independent testing confirmed >99.999% (5 log₁₀) bacterial reduction maintained even after 50 industrial washing cycles

This represents a transformational capability enabling OEMs to specify antimicrobial protection with confidence that performance will persist across vehicle lifespans.

Smart Response Coatings and AGXX Technology

The European Commission’s RELIANCE project synthesized copper-based mesoporous silica nanoparticles (Cu-SMIN) with embedded antimicrobial peptides and essential oils, creating intelligent antimicrobial coatings that activate in response to environmental triggers:

-

pH-triggered release: Antimicrobial agents activate in acidic microenvironments (perspiration conditions)

-

Temperature-triggered release: Bioactive compounds release at body temperature (37°C), maximizing efficacy during use while minimizing unnecessary chemical release during storage

-

ROS generation: Copper particles generate reactive oxygen species disrupting microbial cell membranes and DNA through catalytic reactions powered by environmental moisture

Covestro INSQIN® + Heraeus AGXX represents the most commercially mature next-generation system. AGXX harnesses micro-electric fields generated between two precious metals to eliminate >130 microorganisms. Environmental moisture converts oxygen into reactive oxygen species continuously regenerating antimicrobial properties—eliminating the leaching problem plaguing silver systems. This technology is rapidly scaling across automotive OEM supply chains, particularly for shared mobility and fleet applications where sanitization efficiency directly impacts operational costs.

Smart Textiles: From Passive Comfort to Active Intelligence

Embedded Sensor Integration

Smart textiles transition vehicle cabins from passive environments into dynamically responsive spaces sensing, processing, and adapting to real-time occupant needs. Integration approaches include:

-

Temperature sensing: Real-time measurement of seat surface temperature and microclimate

-

Pressure sensing: Occupancy detection, seating position classification, and load distribution analysis

-

Occupancy classification: Distinguishing driver vs. passenger vs. child positioning—critical for airbag deployment algorithm optimization

-

Health monitoring: Embedded ECG (electrocardiogram) electrodes detecting driver stress and cardiac arrhythmias

Textronics’ flexible ECG fabric (launched 2023) embeds electrodes directly into seat covers, enabling continuous driver health monitoring without external wearables. Tier-1 suppliers including Adient are now licensing this technology for luxury and semi-autonomous platforms, positioning health monitoring as safety-critical rather than optional amenity. Toyota’s “Cabin Awareness” concept uses 4D millimeter-wave radar detecting micro-movements such as heartbeat and respiration, with textile-embedded pressure sensors validating and supplementing sensor data for more sophisticated occupant detection algorithms.

Thermal Regulation Through Phase Change Materials

Phase change materials represent a breakthrough in passive thermal management. PCM absorbs or releases substantial latent heat when transitioning between solid and liquid states at material-specific temperature ranges. For automotive interiors engineered at 30-34°C (human skin temperature), PCM creates natural thermostatic regulation:

-

Cooling effect: PCM absorbs latent heat from seated occupants

-

Heating effect: PCM releases stored heat during cold-weather exposure

-

Energy efficiency impact: Testing confirmed 8-15% reduction in HVAC energy consumption

-

EV range extension: This passive thermal management directly extends driving range by 5-8% without adding battery capacity—critical for mass-market EV competitiveness

Research demonstrated headliner temperatures maintained at comfortable 30°C without active air-conditioning support. Conventional HVAC systems can be substantially downsized, reducing component costs while improving environmental efficiency.

Adaptive Insulation with Shape Memory Materials

Shape memory polyurethane (SMPU) fibers enable textiles dynamically adjusting insulation characteristics in response to body temperature. Laboratory studies confirmed SMPU-integrated seat fabrics:

-

Maintain thermal resistance and water vapor permeability within comfort standards

-

Comply with strict automotive abrasion and tensile strength requirements

-

Provide improved body contour adaptability reducing driver fatigue on extended journeys

-

Support vehicle safety through reduced drowsiness

Market Dynamics and OEM Innovation

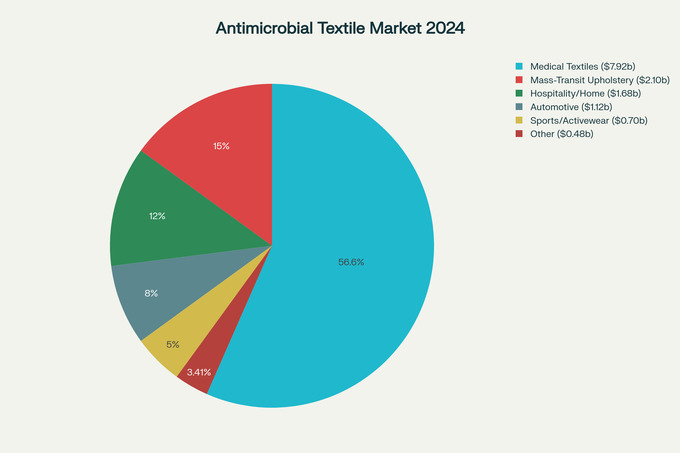

Market Segmentation (2024)

| Segment | Market Share | Value | Status |

|---|---|---|---|

| Medical textiles | 56.59% | $7.92B | Dominant segment |

| Mass-transit upholstery | 15% | $2.1B | Rapidly expanding |

| Hospitality/home furnishings | 12% | $1.68B | Stable growth |

| Automotive | 8% | $1.12B | Highest growth potential |

| Sports/activewear | 5% | $0.7B | Moderate growth |

Antimicrobial Agent Distribution

-

Quaternary ammonium compounds: 32.18% (cost-competitive applications)

-

Chitosan: 10%+ (expanding at 5.04% CAGR as sustainability mandates strengthen)

-

Metal nanoparticles: 25%+ combined share

-

Bio-based alternatives: 15-20% (rapidly expanding segment)

Real OEM Implementations

-

BMW + Schoeller Textil (2024): Developing sustainable smart interiors combining recycled fibers with embedded biometric sensors

-

Tesla: Specifying antimicrobial smart fabrics with UV self-cleaning capability for autonomous fleets

-

Mercedes-Benz EQ: Integrating 100% recycled polyester upholstery with bio-based materials

-

Textronics: ECG monitoring fabrics licensed by Tier-1 suppliers for luxury platforms

Manufacturing and Cost Considerations

Production Technologies

-

Pad-dry-cure process (dominant): Processes 300-600 meters/hour with simultaneous drying/curing

-

Cold atmospheric plasma (emerging): Enables 5-10x material efficiency vs. traditional padding

Material Cost Structure

| Component | Cost/m² | Premium vs. Traditional |

|---|---|---|

| Traditional textile | $3.50-5.50 | Baseline |

| Antimicrobial smart textile | $9-18 | 100-250% premium |

Cost premium justified through:

-

Reduced warranty claims (8-12% reduction)

-

Fleet operational savings ($500-1,000 annually per vehicle)

-

Occupant health benefits (8-15% HVAC reduction)

-

Premium pricing ($500-1,500 interior upgrade premiums)

Lifecycle Analysis: For premium vehicle segments ($50,000+) and fleet vehicles, smart antimicrobial textiles deliver positive return-on-investment within 3-5 years despite material cost premiums.

Regulatory Landscape and Standards

Antimicrobial performance standards (ISO 20743, AATCC 100, ISO 22196, EN 45545, ECHA Biocidal Products Regulation) establish baseline compliance requirements. Smart textile integration lacks mature standardization (as of 2025), creating both risk and opportunity. OEM internal specifications are establishing de facto standards pending formal ISO development, enabling early-adopting manufacturers to influence industry standards alignment.

Strategic Imperatives for Textile Manufacturers

-

Portfolio transformation toward antimicrobial and smart textile specialization ($5-20M capex required)

-

Sustainability differentiation through:

-

GRS certification for recycled content

-

Cradle-to-cradle design

-

Bio-based antimicrobial agents

-

-

Geographic positioning:

-

Asia: Scale conventional antimicrobial capacity for mass-market OEMs

-

Europe: Develop premium smart textiles aligned with sustainability mandates

-

North America: Leverage IRA incentives for domestic innovation

-

-

OEM relationship development: Shift from distributor channels to direct partnerships with automotive procurement teams

-

Technology investment: Advanced fiber hybridization, sensor integration, and sustainable manufacturing

Conclusion

Smart and antimicrobial textiles represent a fundamental restructuring of automotive value chains. The market opportunity is substantial—USD 25.51 billion by 2032 with 14.9% growth in smart segments. For textile manufacturers, this is not a peripheral opportunity but a core strategic imperative. Establishing early adoption in antimicrobial chemistry, smart sensor integration, and sustainable manufacturing practices is essential for competitive positioning.

The technical capabilities exist. OEM demand is unambiguous and accelerating. The window for securing leadership positions—establishing OEM partnerships, building sustainable production capacity, and capturing premium market share—remains open but closing rapidly. Manufacturers who invest now will define the next decade of automotive interior innovation. Those who delay risk permanent competitive disadvantage in one of the highest-growth automotive segments.