China Reroutes Clothes Exports to Europe After US Tariffs Upset Trade

The global textile industry is experiencing a seismic shift as China reroutes clothes exports to Europe following unprecedented US tariff increases that have fundamentally disrupted established trade flows. This strategic pivot represents one of the most significant supply chain realignments in recent decades, with profound implications for European markets, global pricing dynamics, and the future of international textile commerce.

The Great Trade Redirection: Numbers Tell the Story

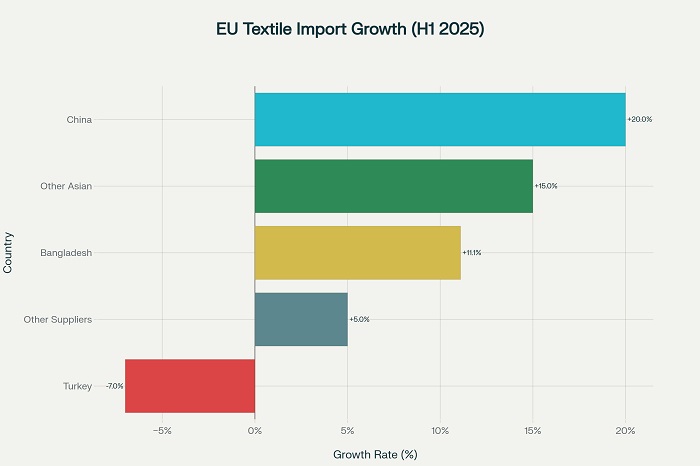

European Union imports of Chinese textiles and clothing surged by an extraordinary 20 percent in both value and volume during the first half of 2025 compared to the same period in 2024. This dramatic increase translated into approximately €2 billion in additional imports flooding European markets, primarily consisting of low-cost garments that were originally destined for American consumers.

The magnitude of this redirection becomes even more apparent when examining the stark contrast in trade flows. While Chinese textile exports to the United States plummeted by 21 percent year-over-year in April 2025, exports to the European Union simultaneously increased by 8.3 percent during the same period. This represents a complete reversal from March 2025, when US-bound exports were still growing at 4.5 percent while EU exports increased by a modest 3.7 percent.

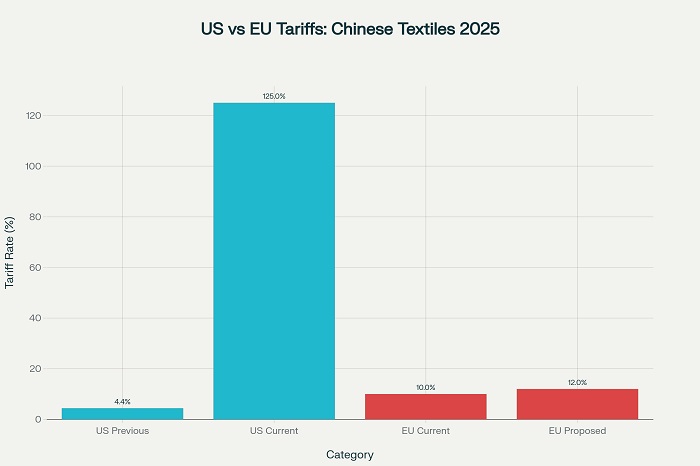

The catalyst for this massive realignment stems from the United States’ aggressive tariff policy, which escalated duties on Chinese textiles from 4.4 percent to an unprecedented 125 percent. This represents an 873 percent increase in tariff rates, effectively pricing Chinese manufacturers out of the American market and forcing them to seek alternative destinations for their products.

Europe: The Unintended Beneficiary of Trade Wars

Mario Jorge Machado, president of Euratex, the European textile industry association, characterized the situation succinctly: “We are discussing this tariff conflict and observing that China is exporting less to the USA. A considerable share is being redirected to Europe, which also correlates with a decline in prices for the items we are importing”. His assessment reflects a broader industry recognition that China reroutes clothes exports to Europe not by choice, but by necessity.

The European market has emerged as a natural alternative for several compelling reasons. First, the composition of Chinese exports to both the United States and European Union remains remarkably similar, making Europe an obvious substitute destination. Second, established supply chain networks, which have expanded significantly since the last China-US trade conflict, facilitate this rapid redirection of goods.

Germany has emerged as a particular beneficiary of this trade diversion, with textile imports from China surging by 20.4 percent in April 2025. The Netherlands and France have similarly experienced substantial increases, with imports growing by 31 percent and 24 percent respectively. These countries now serve as major distribution hubs for Chinese textiles entering the broader European market.

The E-commerce Factor: Small Parcels, Big Impact

The redirection of Chinese textile exports to Europe has been significantly amplified by the growth of e-commerce platforms, particularly Shein and Temu. These platforms have exploited the European Union’s €150 de minimis threshold, which allows small parcels to enter the bloc without incurring customs duties. This regulatory loophole has created what industry experts describe as a “tsunami of low-value parcels” flooding European markets.

Statistics reveal the scale of this phenomenon: 91 percent of all e-commerce shipments valued under €150 entering the EU originated from China in 2024. The total volume reached approximately 4.5 billion parcels imported into the EU in 2024, representing a sharp increase from previous years. By contrast, the United States has effectively closed similar loopholes, implementing measures that subject nearly all imported parcels to minimum duties.

The European Commission has responded with proposals to eliminate the €150 threshold entirely and introduce a €2 handling fee for small parcels, with reduced fees for items shipped from European warehouses. However, these changes are not expected to take effect until 2028, leaving European markets vulnerable to continued influxes of low-cost Chinese goods in the interim.

Economic Implications: Deflationary Pressures and Market Disruption

The massive influx of competitively priced Chinese textiles is creating complex economic dynamics across Europe. The European Central Bank has projected that this trade diversion could dampen inflation in the eurozone by up to 0.15 percentage points as cheaper imports flood consumer markets. While this may provide short-term relief to inflation-conscious consumers, it raises concerns about longer-term market distortions.

European textile manufacturers are sounding alarm bells about what they perceive as unfair competition. The European textile and clothing sector, which generates approximately €170 billion annually and employs more than 1.3 million people, faces mounting pressure from aggressively priced imports. Industry associations have warned of risks from dumping practices, unsustainable price competition, and the potential erosion of domestic production capacity.

French textile companies have been particularly vocal about these challenges. Léa Marie, secretary-general of Slip Français, indicated that her company is in “direct competition” with Asian imports and has invested in campaigns to educate consumers about the job creation benefits of purchasing French-made products. This reflects a broader industry effort to differentiate domestic production based on quality, sustainability, and local economic impact rather than competing solely on price.

Supply Chain Realignment: Beyond Simple Redirection

The current trade redirection represents more than a temporary adjustment to tariff policies; it signals a fundamental apparel supply chain shift that could reshape global textile production for years to come. Chinese manufacturers have adopted sophisticated strategies to navigate the new trade landscape, including front-loading shipments ahead of tariff deadlines, scaling up e-commerce exports, and diversifying supply chains through new logistics hubs.

Chinese authorities have pledged targeted support to help affected exporters redirect sales to domestic or third markets, providing the financial backing necessary to absorb reduced profit margins and maintain competitiveness in new markets. This coordinated approach has enabled many Chinese textile producers to maintain production levels despite losing access to the lucrative American market.

The global nature of this realignment extends beyond the China-Europe axis. Southeast Asian markets have experienced remarkable growth, with ASEAN destinations witnessing a 20.8 percent increase in Chinese exports, led by Indonesia (+36.8 percent), Thailand (+27.9 percent), and Vietnam (+22.5 percent). This diversification reflects Chinese manufacturers’ strategic efforts to reduce dependence on any single market and build resilience against future trade disruptions.

Policy Responses and Future Outlook

European policymakers find themselves caught between competing pressures. Consumer benefits from lower-priced goods must be weighed against the long-term health of domestic textile industries and fair competition principles. The proposed elimination of the de minimis threshold represents a significant policy shift, but implementation challenges remain substantial.

Industry groups are demanding more aggressive action, with some associations proposing handling fees as high as €20 to finance enhanced customs checks and strengthen border controls. French and Italian textile brands have launched campaigns encouraging consumers to “buy local,” emphasizing the environmental and economic costs of fast fashion imports.

The diplomatic dimension adds another layer of complexity. Beijing has already voiced strong objections to the EU’s proposed small-parcel fee, characterizing it as trade distortion and calling for a “fair, transparent and non-discriminatory” approach. This signals potential tensions in broader EU-China trade relations as European officials attempt to balance market access with domestic industry protection.

Global Trade Architecture in Transition

The redirection of Chinese textile exports to Europe represents a microcosm of broader changes in global garment trade patterns. Traditional supply chain configurations, built around cost efficiency and established logistics networks, are giving way to more complex arrangements influenced by geopolitical considerations, regulatory differences, and sustainability requirements.

China’s share of global clothing exports has declined to 29.6 percent in 2024, the lowest level since 2010, yet this decline masks the country’s continued dominance in textile production and supply chain integration. Chinese companies have maintained their position as critical suppliers of raw materials and intermediate goods to manufacturing hubs worldwide, ensuring continued influence over global textile production even as finished goods exports shift.

The emergence of alternative manufacturing centers in Vietnam, Bangladesh, India, and Turkey reflects ongoing supply chain diversification efforts that predate current trade tensions. However, the scale and speed of current changes, driven by dramatic tariff differentials, represent an acceleration of trends that might otherwise have evolved over decades.

Consumer and Industry Adaptation Strategies

For European consumers, the immediate impact of China’s export redirection has been largely positive, with increased product availability and competitive pricing across textile categories. However, industry experts warn that this apparent benefit may come at the cost of reduced product quality, questionable labor standards, and environmental concerns associated with fast fashion production methods.

European textile companies are responding with various adaptation strategies. Some focus on premium positioning, emphasizing quality, durability, and sustainable production methods that justify higher price points compared to Chinese imports. Others are investing in technological innovation, automation, and supply chain optimization to maintain competitiveness while preserving domestic production capacity.

The role of brand differentiation has become increasingly important as companies seek to establish clear value propositions that extend beyond price competition. Emphasis on traceability, near-shoring, sustainable materials, and transparent supply chains represents an effort to compete on factors other than cost alone.

Regulatory Evolution and Market Structure

The current situation has exposed significant gaps in international trade governance, particularly regarding e-commerce and small-parcel shipments. The disparity between US and European approaches to de minimis thresholds has created regulatory arbitrage opportunities that Chinese companies have effectively exploited.

Future regulatory developments will likely focus on harmonizing international standards for cross-border e-commerce, implementing more sophisticated risk assessment mechanisms for small shipments, and developing frameworks that balance trade facilitation with fair competition principles. The European Union’s proposed 2028 customs reform represents an early attempt to address these challenges, though implementation details remain under negotiation.

The broader implications extend to World Trade Organization frameworks and bilateral trade agreements, as traditional trade rules struggle to address the complexities of modern digital commerce and supply chain integration. The current redirection of Chinese textile exports highlights the need for updated international trade architecture that can accommodate rapid shifts in global production and distribution patterns.

As China reroutes clothes exports to Europe in response to US trade policies, the global textile industry continues to adapt to an increasingly complex and politically influenced trading environment. The ultimate resolution of these tensions will shape international commerce patterns for years to come, with implications extending far beyond the textile sector itself.