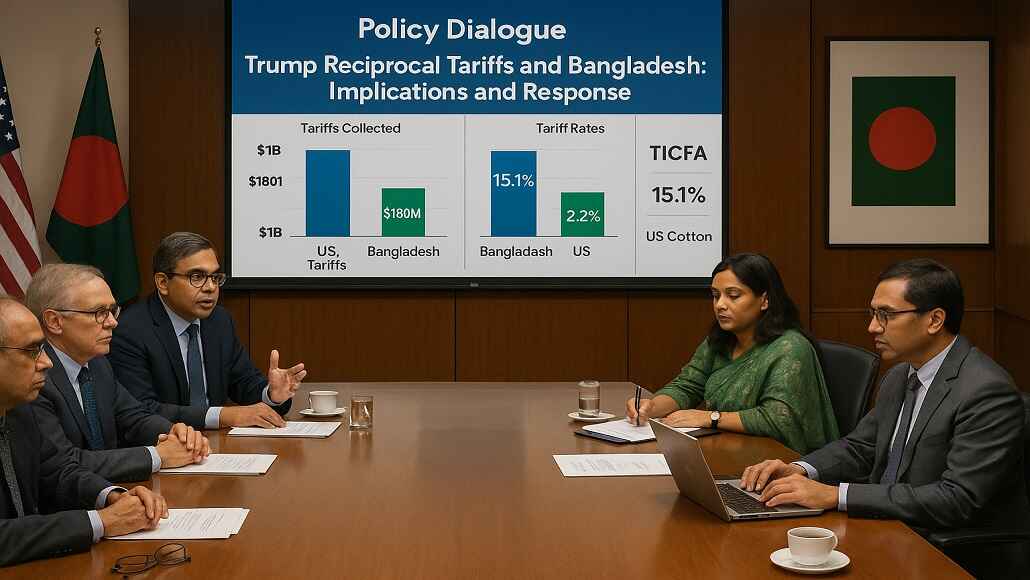

An analysis by the Centre for Policy Dialogue (CPD) has shown that the United States gathers over $1 billion annually in tariffs on goods exported from Bangladesh. Conversely, Bangladesh collects approximately $180 million in duties on products imported from the US.

Although Bangladesh applies an average customs duty of 6.2% on US imports, this figure decreases to a weighted average of 2.2% when rebates are taken into account. In comparison, the weighted average tariff on US imports from Bangladesh is significantly higher at 15.1%.

These figures were presented during a recent dialogue in Dhaka, titled “Trump Reciprocal Tariffs and Bangladesh: Implications and Response.”

The CPD has advised the Bangladeshi government to closely assess the effects of US tariffs on its export competitiveness, especially in relation to countries such as Vietnam. They recommended exploring strategic options, such as engaging with the US through the Trade and Investment Cooperation Forum Agreement (TICFA).

Additionally, Bangladesh might consider providing special warehouse facilities for the import of US cotton, which could facilitate discussions on tariff exemptions for apparel produced with US cotton, according to the think tank’s suggestions.