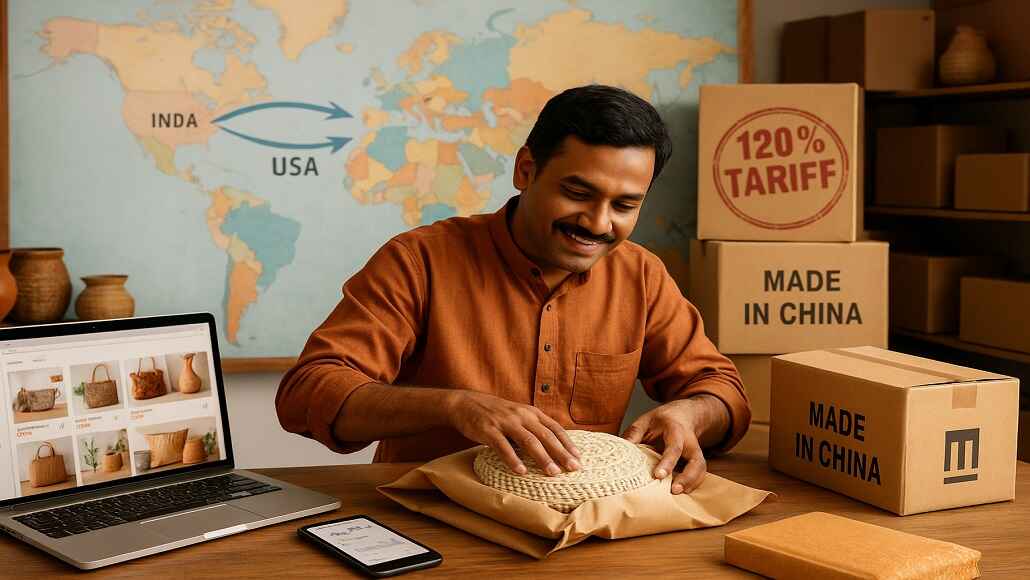

Experts have observed that the recent US restrictions on low-value Chinese e-commerce shipments have created a unique and potentially profitable opportunity for Indian exporters of products such as handicrafts, fashion items, and home goods. According to a report from the Global Trade Research Initiative (GTRI), India, with over 100,000 e-commerce sellers and current exports totaling $5 billion, is well-positioned to take advantage of the gap left by China, particularly in the market for customized, small-batch products. This presents a significant opportunity for Indian exporters, enabling them to capture a share of the market previously dominated by Chinese goods.

However, the report emphasizes that reforms are essential to fully capitalize on this opportunity for Indian exporters.

On April 2, US President Donald Trump enacted an executive order that eliminated the de minimis exemption for imports from China and Hong Kong. This previous regulation allowed small packages valued up to $800 to enter the US duty-free, benefiting certain US and Chinese enterprises.

In addition, Trump increased tariffs on Chinese goods, including those sold online. Starting from May 2, all e-commerce shipments from China and Hong Kong will incur a 120% import duty, marking the end of their duty-free status. The per-item duty will rise from $75 to $100 between May 2 and May 31, and then increase further to $200 beginning June 1.

The GTRI report notes that while other nations maintain de minimis privileges, the window for Indian exporters may be limited, as the US government has indicated potential future expansions of these restrictions.

Currently, India’s trade framework is primarily designed for large, traditional exporters, rather than for small online sellers. The report highlights that red tape often outweighs the available support for these e-commerce businesses.

Additionally, Indian banks present a significant challenge for exporters, as they struggle to manage the high volume and low-value nature of e-commerce transactions. Many online sellers face difficulties in obtaining affordable loans. While larger companies can secure loans at interest rates of 7-10% and utilize purchase order financing, smaller online sellers often face rates of 12-15% and are excluded from public credit initiatives. The report suggests that including them in priority sector lending could help create a more equitable environment for all exporters, further enhancing the opportunity for Indian exporters to thrive in this evolving market.