Key Takeaways

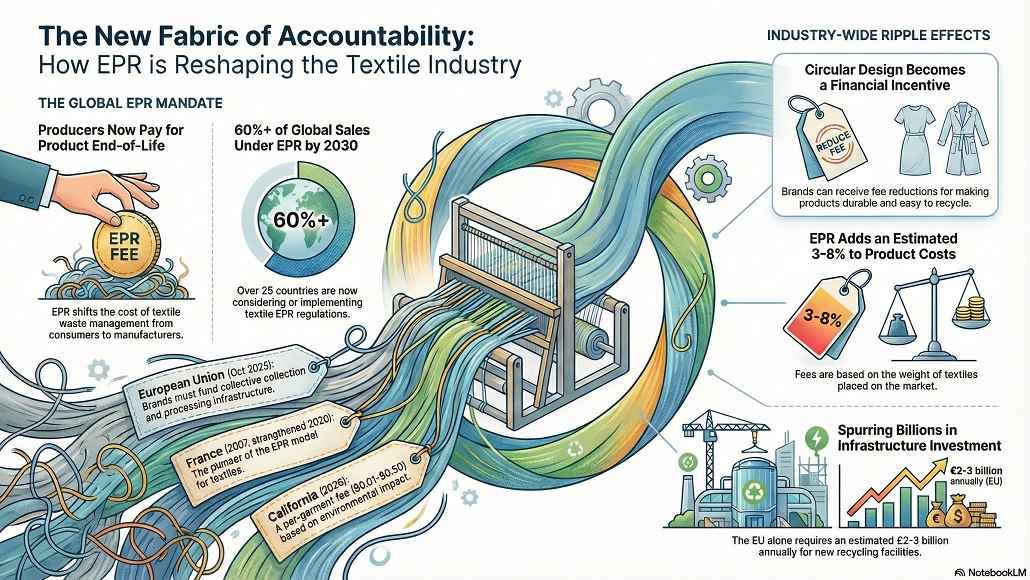

- EU textile regulation effective October 2025 mandates EPR for all brands/manufacturers selling in EU; EPR fees fund collection and processing infrastructure

- France’s AGEC law pioneered EPR model (2007, strengthened 2020) requiring producer financial responsibility for textile end-of-life; pioneered global EPR framework

- California’s EPR legislation (effective 2026) extends US regulation to retail textile sales establishing $0.01-$0.50/garment EPR fee based on environmental impact

- EPR systems shift end-of-life cost burden from municipalities/consumers to producers, creating direct economic incentive for circular design

- Global EPR adoption spreading: 25+ countries considering textile EPR regulations; projections suggest 60%+ global sales under EPR frameworks by 2030

- Regulatory harmonization ongoing but fragmented; multiple competing EPR models creating compliance complexity for multinational brands

The Policy Revolution Reshaping Textile Accountability

For decades, the apparel industry operated under linear business models where manufacturer responsibility ended at point of sale. End-of-life textile management what happened to discarded garments remained public sector responsibility or individual consumer choice. This fundamental disconnect enabled waste generation to expand without corresponding accountability.

Global regulatory frameworks are now eliminating this disconnect. Extended producer responsibility (EPR) policies, circular economy mandates, and textile-specific regulations are making producers financially and operationally responsible for product end-of-life management. This policy restructuring is catalyzing industry transformation toward circular models at pace and scale no voluntary initiative achieved.

Extended Producer Responsibility: The Regulatory Driver

Extended producer responsibility represents core policy mechanism restructuring textile industry accountability. EPR shifts financial and operational responsibility for product end-of-life from public sector and consumers to producers manufacturers and brands placing products on market.

Under EPR frameworks, producers fund collection infrastructure, support material processing, and maintain accountability for recycling rates. This financial responsibility creates direct economic incentive: minimizing end-of-life costs drives product redesign toward recyclability, material selection toward processing-friendly options, and investment in recycling partnerships.

European Union Textile Regulation: Comprehensive EPR Mandate

The European Union adopted comprehensive textile regulations effective October 2025, establishing EPR requirements across all member states. The regulation mandates:

Producer Responsibility: All brands and manufacturers selling textiles in EU are financially responsible for end-of-life textile management. Financial responsibility flows to collective producer responsibility organizations (PROs) industry-funded entities managing collection and processing.

Fee EPR Structure: Producers pay EPR fees proportional to product volume placed on market. Fee levels vary by member state (approximately €0.15-€0.50 per kilogram of textile placed on market) and reflect processing cost estimates. Higher-environmental-impact products may face higher fees; products incorporating recycled content or designed for recyclability may receive fee reductions.

Collection Infrastructure: PROs collectively fund and operate collection systems retail collection points, municipality partnerships, take-back programs enabling consumers convenient access to textile recycling. Collection target minimum of 50% of textile waste by 2030, increasing to 90% by 2040.

Traceability and Transparency: Regulations require tracking of material flows, processing outcomes, and recycling rates. Brands must document their textile waste management and publish sustainability disclosures.

This EU regulation creates comprehensive framework compelling industry transformation across 27 member states representing approximately 10% of global apparel market but concentrated in wealthiest, most influential markets.

France’s AGEC Law: The EPR Pioneer

France pioneered textile EPR regulation through successive AGEC (Anti-Waste for Circular Economy) laws: initial framework in 2007, strengthened substantially in 2020. France’s experience provides global template and implementation lessons.

France’s EPR framework established in 2007 created ECOTEX (Eco-Organisme Textiles) collective producer responsibility organization managing EPR fees and collection infrastructure. This organization established France’s textile collection system and funded approximately 4,600 collection points.

The 2020 AGEC law strengthened requirements: increased producer financial responsibility, expanded collection targets, established design-for-recycling standards, and imposed reporting and transparency requirements. This evolution demonstrates policy learning initial frameworks proved insufficient, requiring strengthening.

France’s implementation experience reveals operational insights: collection infrastructure requires substantial upfront investment; consumer participation requires sustained awareness campaigns; processing infrastructure must precede collection expansion or material accumulation occurs. These lessons inform policy design elsewhere.

California’s Emerging EPR Framework

California, representing approximately 12% of US apparel consumption, is implementing textile EPR regulation effective 2026. The framework establishes USD 0.01-0.50 per garment EPR fee based on environmental impact assessment. Different product categories face different fee levels reflecting processing difficulty and environmental impact.

California’s approach attempts to create price incentive: products designed for recyclability, incorporating recycled content, or utilizing lower-environmental-impact materials qualify for lower EPR fees; products difficult to recycle face higher fees. This fee differentiation creates explicit economic incentive for sustainable design.

California’s framework includes collection targets (65% by 2032) and processing infrastructure requirements. The regulation emphasizes waste reduction through reuse and repair alongside recycling, recognizing that extended product lifecycle represents superior environmental outcome compared to recycling.

Global Policy Proliferation and Harmonization Challenges

EPR regulation is spreading globally. More than 25 countries are actively considering or implementing textile EPR frameworks. Switzerland, Norway, and several other European countries have implemented or are finalizing regulations. Canada, Australia, and other developed markets are developing frameworks.

Industry projections suggest that 60-70% of global apparel sales will occur in EPR-regulated jurisdictions by 2030, creating comprehensive pressure for circular business models across major brands.

However, this global expansion creates fragmentation challenge. Different jurisdictions implement EPR differently: varying fee structures, collection targets, timeline requirements, and transparency mandates. A multinational brand must navigate multiple compliant regimes simultaneously, increasing compliance cost and complexity.

Regulatory harmonization initiatives are attempting to develop common standards. The UNEP (United Nations Environment Programme) is facilitating international dialogue regarding EPR best practices. However, full harmonization remains years away if achievable at all given national regulatory autonomy.

Design-for-Recycling Requirements

Emerging regulations increasingly specify design requirements supporting recyclability. EU regulations encourage “design for circularity,” with specific mention of mono-material construction, disassembly capability, and durability standards. California’s framework similarly emphasizes design requirements.

These regulations lack absolute mandates but create regulatory preference: designers incorporating recycling-friendly specifications may qualify for EPR fee reductions; designs ignoring recycling considerations may face higher fees. This incentive structure gradually shifts design practices.

Economic Impact: Producer Cost and Brand Response

EPR regulations create new cost streams for producers. Estimated EPR fee burden ranges approximately EUR 0.15-0.50 per kilogram of textile placed on market representing 3-8% additional product cost depending on product weight and fees applicable.

This cost burden has motivated brand responses: some brands are absorbing costs and raising retail prices modestly; others are implementing cost-reduction strategies through circular design or supply chain optimization; some are investing directly in recycling infrastructure partnerships.

Large brands have sufficient scale to absorb EPR costs and develop strategic recycling partnerships. Smaller brands struggle with cost burden and compliance complexity, potentially consolidating toward larger companies or exiting affected markets.

Behavioral Impact: Consumer Participation and Collection Rates

EPR regulations fund collection infrastructure improving consumer convenience. Early data from France shows that collection availability increases participation dramatically: regions with 100+ collection points achieve 30-40% participation rates; regions with limited infrastructure achieve <10% participation.

This behavioral data indicates that convenience not solely environmental awareness drives recycling participation. EPR-funded infrastructure investment improving convenience should increase collection rates progressively.

Infrastructure Investment Trajectory

EPR policy drivers are catalyzing substantial infrastructure investment. EU estimates suggest EUR 2-3 billion annual investment requirement across member states to achieve collection and processing targets. This investment is flowing toward:

Collection infrastructure: Collection points, logistics networks, administrative systems Sorting facilities: NIR and AI-powered sorting systems Processing infrastructure: Mechanical and chemical recycling facilities

This infrastructure investment enables scaling previously limited by capital availability. Public EPR funding provides first-mover advantage, reducing financial risk and accelerating infrastructure deployment.

Looking Forward: Policy Momentum and Industry Transformation

Regulatory momentum toward comprehensive EPR and circular economy frameworks appears irreversible. Even countries without current regulations are responding to competitor pressure and recognizing EPR as inevitable requirement for market access.

This policy transformation is creating structured incentive for industry change. Where voluntary initiatives achieved limited adoption, regulatory requirements are compelling comprehensive business model transformation. Within 5-10 years, circular design, recycling partnerships, and end-of-life accountability will transition from competitive differentiator to baseline industry requirement.