Every year, 92 million tonnes of textile waste enters landfills and incinerators globally, with projections reaching 134 million tonnes by 2030. This staggering volume represents both an environmental crisis and an extraordinary economic opportunity that the fashion industry is only beginning to recognize. Today, recycled textiles have evolved dramatically from a niche sustainability practice into a comprehensive industrial system powered by mechanical innovation, advanced chemical engineering, and cutting-edge artificial intelligence. Understanding how fashion waste transforms into high-performance new fabrics offers crucial insights into circular economy sustainability and the future trajectory of fashion manufacturing worldwide.

The transformation of fashion waste into viable materials exemplifies how modern manufacturing systems can embrace sustainability without sacrificing quality or economic viability. What was once considered refuse destined for landfills now represents valuable feedstock for textile recycling technology systems. Rather than viewing textiles as linear products, industry leaders increasingly recognize them as renewable assets in regenerative systems. This fundamental shift reflects deeper changes in how we conceptualize value, waste, and resource management across global supply chains.

THE CRISIS AND THE OPPORTUNITY

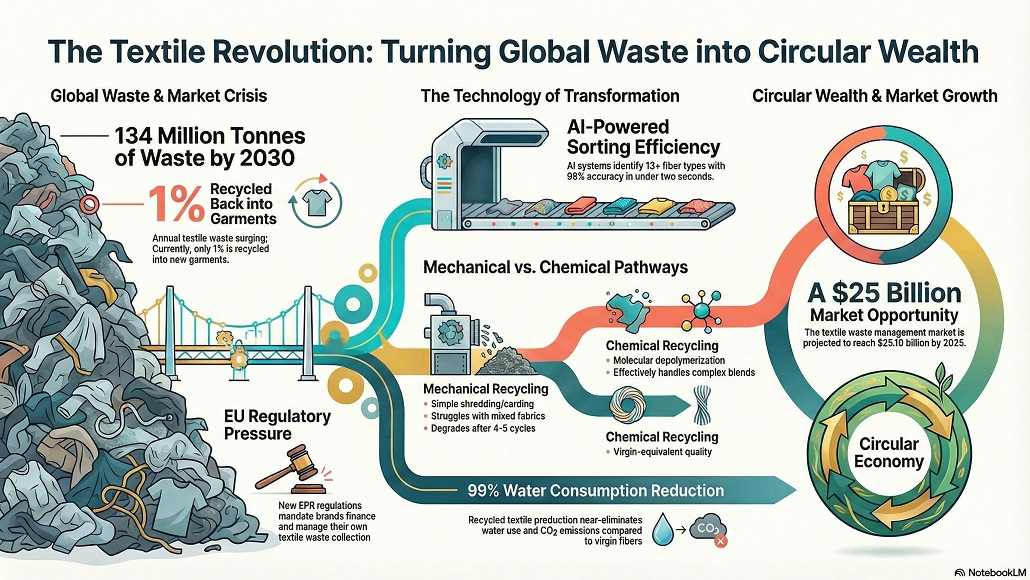

The scale of the problem demands immediate context. Consider that 80 to 100 billion garments are consumed annually, yet only 12% of all clothing materials are recycled worldwide. More striking, just 1% of used clothing becomes recycled textiles that are transformed back into new garments. Instead, 57% of textile waste ends up in landfills while 25% is incinerated, with 87% of textile fibers ultimately facing environmental harm. The fashion industry accounts for 10% of global greenhouse gas emissions while generating 20% of industrial wastewater, making textile waste management not merely an environmental concern but an urgent business imperative.

This crisis, however, masks tremendous economic potential. The global circular economy is experiencing explosive growth in the textile sector. The circular fashion market reached USD 6.5 billion in 2025 and is projected to reach USD 9.24 billion by 2029, expanding at a 9.1% compound annual growth rate. Even more compelling, the broader textile waste management market is valued at USD 11.37 billion in 2025 and is expected to reach USD 25.10 billion by 2035, growing at an 8.24% CAGR. This dual acceleration environmental urgency combined with market opportunity creates unprecedented momentum for innovation in recycled textiles production and upcycled textiles development.

THE ECONOMICS OF RECYCLED TEXTILES

What drives this explosive growth in recycled textiles and upcycled textiles adoption? The economic fundamentals have shifted decisively. Recycled textile production requires zero farmland, eliminates pesticide dependence, dramatically reduces water consumption by up to 99%, and achieves near-zero CO2 emissions compared to virgin fiber production. For manufacturers and brands, this translates into substantial cost savings, regulatory compliance advantages, and enhanced market positioning where environmental consciousness increasingly drives purchasing decisions. Companies investing in textile recycling technology gain competitive advantages through reduced material costs and access to sustainability-conscious consumer segments willing to pay premium prices for sustainable fabrics.

Asia Pacific currently dominates the market with 29% share, though North America experiences the fastest growth trajectory driven by stricter environmental regulations and consumer activism. The European Union has emerged as the regulatory frontier, mandating that companies assume responsibility for textile waste through Extended Producer Responsibility (EPR) regulations. These regulations require manufacturers and brands to finance and engage actively in collection, sorting, and recycling operations. France’s Refashion organization collected over 250,000 tonnes of textiles in 2022 for reuse and recycling, demonstrating the capacity that emerges when regulatory frameworks align with infrastructure investment.

HOW RECYCLED TEXTILES ARE CREATED: TWO PRIMARY PATHWAYS

Mechanical Recycling: The Established Foundation

Mechanical recycling remains the most widely adopted method for transforming textile waste into new materials. This process begins with collection and sorting of post-consumer and industrial textile waste. Workers and increasingly automated systems separate reusable items from those destined for fiber recovery. The textiles are then shredded into fragments, converted into open fibers through industrial machinery. These fibers undergo carding a crucial process that prepares materials for spinning into new yarns that can subsequently be woven or knitted into finished textiles for new garments.

The fundamental advantage of mechanical recycling lies in its simplicity and cost-effectiveness. The process requires modest capital investment compared to chemical alternatives and can operate across diverse facility scales. However, significant limitations exist. Mechanical recycling degrades fiber strength with each recycling cycle, typically allowing only 4-5 recycling iterations before quality becomes unviable. This necessitates blending recycled fibers with virgin materials to achieve adequate tensile strength for commercial applications. Additionally, mechanical recycling struggles dramatically with blended fabrics—the polyester-cotton combinations, nylon-spandex blends, and elastane-mixed garments that dominate post-consumer textile waste streams. These complex compositions represent a substantial portion of total textile waste, effectively sidelining them from high-value recycled textiles recovery through mechanical methods alone.

Chemical Recycling: Advanced Solutions for Complex Materials

Chemical recycling, also termed depolymerization, represents a more sophisticated pathway that directly addresses mechanical recycling’s fundamental limitations. This process involves breaking down textile fibers at the molecular level using specialized chemical processes to create new raw materials equivalent to virgin fibers. Two primary chemical methods have emerged as technologically viable: dissolution and depolymerization. Dissolution selectively separates materials using specific solvents, while depolymerization breaks polymer chains to convert them into base monomers.

For polyester textiles, depolymerization via solvolysis efficiently recovers base monomers, enabling creation of new polyester fibers with virgin-equivalent strength and performance characteristics. Cotton and cellulosic fibers can be processed through chemical dissolution, effectively breaking down the material into reusable polymers. Polyamide (nylon) responds to depolymerization through acid hydrolysis or enzymatic approaches, though these remain less economically optimized than polyester processes. The transformative advantage of chemical recycling lies in enabling infinite recyclability. Unlike mechanically recycled fibers that degrade progressively, chemically recycled fibers possess identical strength and performance to virgin fibers, theoretically enabling endless recycling cycles without quality degradation. This creates true textile-to-textile closed-loop systems rather than the downcycling inherent in mechanical methods.

However, chemical recycling faces significant economic obstacles. Processing costs substantially exceed mechanical recycling—often by multiples—and the technology remains concentrated in limited facilities across Europe and North America. Environmental concerns regarding chemical inputs, process water consumption, and energy requirements add complexity to the sustainability calculation, though emerging technologies are actively addressing these concerns. Despite these challenges, chemical recycling represents the future direction of high-value textile recycling technology systems, particularly for handling blended fabrics that mechanical approaches cannot process.

THE ARTIFICIAL INTELLIGENCE REVOLUTION IN TEXTILE SORTING

The most transformative recent development in recycled textiles production involves deployment of artificial intelligence and advanced automation systems. Historically, textile sorting has been profoundly labor-intensive, requiring thousands of workers to manually evaluate each garment based on fiber type, color, contamination level, and condition. This dependency on manual labor constrained scaling potential, inflated operational costs, and created geographic limitations tied to wage dynamics.

AI-powered sorting systems have fundamentally reordered this value chain. Modern systems now achieve 95-98% accuracy in identifying 13 or more fiber types in under 2 seconds per garment, substantially exceeding human capability. These systems employ convolutional neural networks that process near-infrared spectral data to classify fibers by composition, color, and contamination level. Integrated near-infrared (NIR) plus vision systems approach 98% classification accuracy, translating directly to improved downstream processing outcomes and superior-quality recycled fiber output.

The economic implications are profound and immediate. AI-driven sorting reduces overall textile recycling technology costs by 25-35% through efficiency gains that quickly offset automation capital investment. Machine learning models continuously improve through training datasets, achieving incremental accuracy gains of 1-2% quarterly. These systems also reduce manual labor requirements by 70-80%, substantially improving worker safety while redirecting human effort toward higher-value tasks. By 2030, industry analysts project that 60% or more of commercial textile recycling facilities will employ AI-driven sorting systems, compared to less than 5% in 2023 representing a rapid industry transition.

Hyperspectral imaging represents another frontier in automated textile processing. By capturing data across multiple wavelengths beyond human visual perception, hyperspectral systems identify contaminants, dyes, and material compositions with unprecedented precision. Companies like Refiberd have deployed hyperspectral cameras that enhance sorting accuracy beyond traditional visual inspection, enabling recovery from textile waste streams previously considered non-recoverable.

BRAND LEADERSHIP IN CIRCULAR MODELS

Industry leadership in recycled textiles and upcycled textiles extends beyond technological innovation to encompass business model transformation. Patagonia’s Worn Wear initiative has extended the life of over 100,000 garments through take-back, repair, and resale programs. Launched in 2017, this closed-loop system diverts substantial volumes from landfills while creating secondary markets that enhance customer loyalty and demonstrate that circular models can achieve commercial viability.

RE/DONE built an entire global fashion brand around upcycling principles, originally transforming vintage Levi’s into contemporary designs. The company has diverted 145,000 garments from landfills while establishing itself as a globally recognized premium fashion brand. This trajectory proves definitively that upcycling fashion and sustainability need not compromise commercial ambition or brand desirability.

Urban Outfitters launched Urban Renewal as a dedicated sub-brand specializing in recycled garments and upcycled designs. The offering encompasses multiple categories: remnants and deadstock fabric transformed into new designs, one-of-a-kind pieces unavailable elsewhere, authentic vintage clothing, and upcycled vintage pieces that are customized and redesigned. This diversified approach expands addressable markets while maintaining commercial discipline.

Eileen Fisher operates one of the most sophisticated upcycling programs among mainstream fashion brands. Its Resewn collection transforms other Eileen Fisher pieces including damaged or customer returns into unique upcycled one-of-a-kind items. In 2023 alone, the brand processed over 120,000 garments through this program, demonstrating commercial scale in what was once considered a niche practice.

Outerknown, a denim brand, commits to circularity through its Outerworn initiative enabling customers to buy and sell pre-loved garments for credit, which the brand then upcycles and resells. The brand sources 90% of its fibers from organic, recycled, or regenerated materials, with 100% of its trunks manufactured from recycled or renewable fibers. A lifetime repair, replacement, or recycling guarantee for jeans creates direct incentives for customers to maintain engagement with the brand and participate in circular systems.

MARKET DYNAMICS AND REGULATORY CATALYSTS

Consumer preference for environmentally conscious apparel accelerates among younger demographics. Online distribution channels have revolutionized circular fashion markets, enabling unprecedented access to resale and upcycled products. Online marketplaces facilitate second-hand commerce at scale, connecting sellers with environmentally conscious buyers worldwide. These platforms have achieved 41.8% market share in circular fashion distribution and continue expanding rapidly.

Celebrity endorsers and influencers increasingly amplify circular fashion narratives, translating niche environmental concerns into mainstream aspirational positioning. This visibility catalyzes brand adoption and consumer participation in upcycled textiles and recycled textiles systems. Strategic partnerships between established brands and circular economy specialists proliferate, enabling incumbents to access specialized textile recycling technology capabilities while startups gain distribution and legitimacy.

CHALLENGES AND FUTURE TRAJECTORIES

Critical challenges persist despite remarkable progress. Chemical recycling, while technologically superior for handling blended fabrics, remains economically constrained. Processing costs exceed mechanical recycling substantially, and the technology concentrates in limited geographic regions. Most contemporary garments feature complex blended compositions cotton, polyester, elastane combinations for which no established chemical recycling process currently exists. These combinations represent substantial portions of textile waste, effectively sidelining them from high-value recovery.

Geographic concentration of recycling infrastructure in developed nations while massive textile waste generation occurs in Asia creates efficiency gaps that constrain scaling potential. Future innovation trajectories suggest acceleration through 2030. Enzymatic recycling approaches are emerging as alternatives to chemical depolymerization, potentially offering superior environmental profiles while achieving similar technical performance. Decentralized sorting solutions enabled by edge computing and embedded AI will enable deployment at manufacturing plants and collection centers rather than massive centralized facilities. Blockchain integration for supply chain transparency will advance rapidly, enabling brands to make verifiable circularity claims while facilitating material flow optimization through data analytics.

CONCLUSION

Recycled textiles and upcycled textiles have transitioned decisively from fringe sustainability practices to essential industry components. The convergence of mounting regulatory pressure, surging consumer demand for sustainable fabrics, environmental imperatives, and rapid technological advancement creates compelling conditions for accelerated adoption. Market projections indicate the recycled textiles sector will double in value within five years as infrastructure expands globally and chemical recycling technologies achieve commercial scale through textile recycling technology innovations.

The question for stakeholders is no longer whether to transition toward circular economy systems and invest in textile recycling technology. Rather, the imperative now centers on how rapidly to scale proven approaches and invest aggressively in next-generation innovations that maximize environmental and economic value recovery from the billions of garments destined for discard annually. Industry transformation is underway, accelerating rapidly, and creating unprecedented opportunities for brands, technology providers, and investors aligned with circular economy principles and sustainable fabrics development.