The global textile and apparel industry stands at an inflection point where traceable ethical textile supply chains are no longer aspirational ideals but increasingly mandatory operating standards. What was once considered a competitive advantage—transparency and verifiable sourcing practices—has evolved into an industry expectation driven by regulatory frameworks, consumer activism, and investor scrutiny. As brands worldwide recognize the financial and reputational stakes, the implementation of traceable ethical textile supply chains represents one of the most significant transformations reshaping how garments and fabrics reach global markets.

The Imperative Behind Supply Chain Transparency

The textile industry has historically operated as one of the world’s most opaque sectors. With supply networks spanning dozens of countries and involving countless intermediaries, tracking materials from fiber to finished product proved challenging even for conscientious brands. This opacity created fertile ground for ethical violations, environmental degradation, and greenwashing—the practice of making false sustainability claims. The industry responsible for approximately 10% of global carbon emissions and generating 92 million tons of waste annually faces mounting pressure to transform its operations fundamentally.

Consumer awareness has become a primary catalyst for change. Research indicates that 66% of global shoppers express willingness to pay premium prices for sustainable products when provided with clear, verifiable information. Simultaneously, high-profile industrial disasters—most notably the 2013 Rana Plaza collapse in Bangladesh that killed over 1,100 workers—crystallized the human cost of supply chain invisibility for global audiences.

Regulatory bodies, especially in the European Union, have responded decisively. The EU’s Strategy for Sustainable and Circular Textiles mandates detailed supply chain disclosures, encouraging blockchain and digital passport adoption. Looking ahead to 2026 and 2027, new regulations will transform traceability from optional practice into enforceable requirement. These policy shifts recognizing the urgency of transparency have positioned traceable ethical textile supply chains as compliance prerequisites rather than voluntary initiatives.

Understanding Traceable Ethical Textile Supply Chains

A traceable ethical textile supply chain encompasses the ability to verify and document every stage of textile production—from raw material cultivation through consumer delivery—while ensuring that environmental and labor standards are maintained throughout. This definition goes beyond simple tracking; it demands verification and accountability at each touchpoint. An effective traceable ethical textile supply chain system captures information about fiber origins, processing methods, manufacturing facilities, worker conditions, chemical usage, and environmental impact metrics.

The concept of supply chain transparency emerged from recognition that traditional methods—paper-based records, manual audits, and trust-based relationships—were insufficient for truly understanding production networks. Textile manufacturing fundamentally differs from most industries because a single garment might traverse eight or more countries before reaching retail. Cotton grown in India could be processed in Pakistan, woven in Vietnam, dyed in Bangladesh, cut in Cambodia, sewn in Indonesia, and warehoused in Germany before arriving at consumers in North America or Europe. Within this labyrinth, opportunities for exploitation, environmental harm, and fraud multiply exponentially.

Responsible manufacturing practices integrated within traceable ethical textile supply chains address multiple dimensions simultaneously. Environmental responsibility encompasses water conservation, chemical management, waste reduction, and carbon emission minimization. The industry currently consumes enormous quantities of water—textile production ranks among the highest water-consuming manufacturing sectors globally. Social responsibility ensures fair wages, safe working conditions, elimination of forced and child labor, and respect for worker rights. Quality assurance verifies that claimed material composition, certifications, and production methods align with actual practices.

The Role of Certifications and Standards

Industry certifications have become foundational to building trust within traceable ethical textile supply chains. The Global Organic Textile Standard (GOTS) represents the leading certification for organic textiles, requiring that at least 70% of fibers be certified organic while establishing strict requirements for chemical use, social accountability, and traceability throughout the production chain. GOTS certification mandates that all components of products meet standards and remain traceable from raw material to finished product, with independent third-party verification ensuring credibility.

OEKO-TEX Standards, particularly the STeP (Sustainable Textile and Leather Production) certification, establishes comprehensive requirements across manufacturing facilities. This certification analyzes six critical modules: environmental management, chemical management, wastewater treatment, energy efficiency, social responsibility, and health and safety. Crucially, OEKO-TEX recognition acknowledges existing third-party standards including BSCI, Fair Work Foundation, and ISO certifications, creating a complementary ecosystem of verification.

The Better Cotton Initiative (BCI) specifically targets cotton sourcing, one of textile manufacturing’s most ethically and environmentally fraught areas. BCI certification requires documented and traceable supply chains ensuring sourcing from genuinely sustainable operations while maintaining strong commitments to environmental stewardship and social responsibility. This represents significant progress given that conventional cotton production historically consumed 16% of global pesticides while covering just 2.5% of cultivated land.

For recycled textiles, the Global Recycled Standard (GRS) and Recycled Claim Standard (RCS) provide verification that materials genuinely contain recycled content and underwent environmentally responsible processing. These certifications prove increasingly important as circular economy principles gain traction across the industry. Fair Trade certification extends beyond fabric origins to verify that producers received fair compensation and maintained fundamental labor rights, addressing the income vulnerability that characterizes many textile-producing communities.

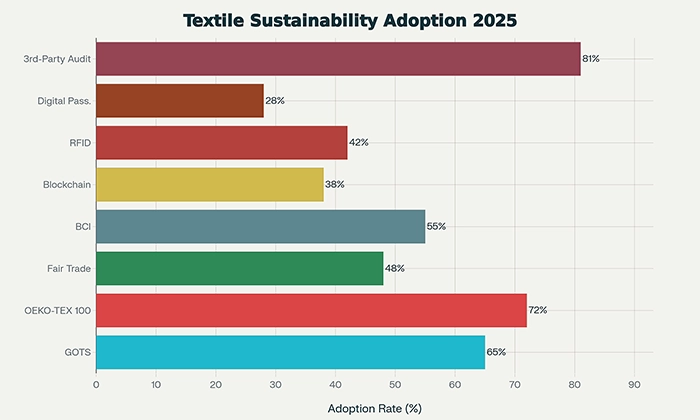

Industry adoption of these certifications reflects growing standardization around what responsible practice means. Leading brands increasingly require multiple certifications, recognizing that robust traceable ethical textile supply chains demand overlapping verification systems. Approximately 81% of global textile companies now conduct third-party supply chain audits, while 72% have adopted OEKO-TEX standards and 65% have implemented GOTS certification. These metrics indicate that the industry has passed an inflection point where sustainability certification has become standard operating procedure.

Digital Technologies Enabling Traceability

Digital innovation has catalyzed the shift toward traceable ethical textile supply chains by making comprehensive tracking economically viable at scale. Blockchain technology provides the foundation for many emerging traceability systems by creating immutable, decentralized digital ledgers recording every transaction and data point in supply chains. Unlike traditional databases that a single entity can alter, blockchain’s distributed architecture makes tampering virtually impossible. Each production stage—from farmer to spinner to dyer to manufacturer to distributor—adds verified records that cannot be retroactively modified.

When a textile producer sources organic cotton from a farm in India, blockchain technology enables the farm to issue a digital certificate of origin. As cotton moves through spinning mills, dyeing units, and manufacturing facilities, each stage contributes a credential verifying ethical labor practices, certified dye usage, compliance with environmental standards, and adherence to production schedules. Consumers accessing the final garment can instantly verify its complete journey, creating transparency that builds brand trust while deterring fraudulent sourcing claims.

Radio-Frequency Identification (RFID) tags represent another enabling technology within traceable ethical textile supply chains. These passive or active electronic tags can track individual textile items, batches, or containers throughout production and distribution networks. Unlike barcodes requiring line-of-sight scanning, RFID enables automated inventory management, reducing errors and providing real-time visibility. Molecular tagging technology embeds unique identifiers directly into textile fibers themselves, making adulteration or mixing with non-certified materials immediately detectable.

Digital Product Passports (DPPs) represent perhaps the most visible manifestation of traceable ethical textile supply chains from consumer perspectives. These digital records, accessed via QR codes embedded in garment labels, contain comprehensive information about materials, production processes, environmental footprint, repair history, and recyclability. The EU’s implementation timeline, with specific requirements anticipated by January 2026 and enforcement beginning July 2027, positions DPPs as industry standard.

Enterprise Resource Planning (ERP) systems and supply chain management platforms integrate data from multiple sources, creating unified dashboards where brand managers can monitor every aspect of production networks simultaneously. AI-powered analytics within these platforms predict supply chain disruptions, identify ethical risks, and recommend corrective actions before problems escalate. Integration with supplier databases, production tracking software, and quality control systems creates end-to-end visibility transforming textile manufacturing from an opaque process into a monitored, data-driven operation.

Industry Adoption and Market Transformation

The shift toward traceable ethical textile supply chains has accelerated dramatically across recent years, driven by converging pressures. Approximately 70% of global brands report planning comprehensive overhauls of their sourcing models, prioritizing fabric quality, ethical production, and digital innovation over cost minimization. This represents fundamental reorientation away from traditional fast-fashion models reliant on opacity and information asymmetry toward value-driven approaches emphasizing transparency and accountability.

Leading fashion brands have become champions of supply chain traceability, recognizing competitive advantages in differentiation and consumer trust. Patagonia’s blockchain-enabled system allows consumers to trace supply chain origins for sustainable clothing lines, building brand loyalty through verified commitments. Stella McCartney partnered with the Provenance platform to track viscose fabric ethical sourcing, allowing QR code scanning to reveal complete supply chain histories. H&M piloted blockchain integration with VeChain specifically for sustainable clothing lines, demonstrating that even high-volume retailers can implement traceability systems profitably.

Nearshoring and regional production trends reinforce transparency adoption. As brands move production closer to end markets—expanding operations in Latin America and Eastern Europe while reducing reliance on distant Asian suppliers—supply chain complexity paradoxically decreases while visibility opportunities increase. Shorter supply chains with fewer intermediaries enable more comprehensive monitoring of working conditions and environmental practices.

Overcoming Implementation Challenges

Despite significant progress, implementing traceable ethical textile supply chains across globally dispersed production networks presents formidable challenges. The textile industry’s fundamental fragmentation—with thousands of small and medium enterprises, informal operations in developing regions, and suppliers reluctant to share competitive information—complicates standardization efforts. Many facilities in textile-producing nations still operate with limited digital infrastructure, making technology adoption technically challenging and financially burdensome.

Data integration complexity poses significant obstacles. Textile supply chains typically involve 15-20 distinct stages across numerous countries, with different stakeholders using incompatible systems and data protocols. Creating unified information ecosystems where data flows seamlessly from farms through retail outlets demands extraordinary coordination. Standards organizations like GRI (Global Reporting Initiative) work toward consistent metrics and reporting requirements, but achieving universal adoption across diverse jurisdictions remains aspirational rather than realized.

Verification authenticity presents significant challenges despite technological sophistication. Blockchain’s immutability means nothing if initial data entry proves fraudulent—technology can only verify claims that inputs were accurate. Creating effective third-party audit systems ensuring data integrity demands trained inspectors, sophisticated detection systems, and sufficient resources for verification. Greenwashing risks persist even within traceable systems if unethical actors submit false documentation or manipulate compliance claims.

Regulatory Frameworks Reshaping Industry Standards

Global regulatory evolution constitutes perhaps the most powerful driver accelerating traceable ethical textile supply chains toward universal adoption. The EU’s legislative approach, most prominently through the Digital Product Passport requirement and Extended Producer Responsibility (EPR) mandates, positions regulatory compliance as market access requirement. Companies operating within EU markets or selling to EU consumers must implement required traceability systems regardless of production location.

The EU’s proposed Textiles & Apparel Sector Standard, under GRI consultation until September 2025, will establish globally consistent metrics for textile supply chain reporting. This standardization effort addresses the current fragmentation where different organizations apply inconsistent measurement approaches. By creating universal standards, regulators aim to enable meaningful comparison between producers and prevent the “standards shopping” where companies comply with weakest applicable regulations.

UK initiatives like British Pasture Leather and Billy Tannery represent regional efforts promoting homegrown, traceable supply chains emphasizing sustainability and ethical production. These models demonstrate that traceability need not always mean global supply chains; sometimes shorter, regional networks provide superior transparency and environmental performance.

The Corporate Sustainability Due Diligence Directive (CSDDD) requires EU companies to implement rigorous due diligence throughout supply chains to prevent human rights violations and negative environmental impacts. This extends beyond apparel to any company doing business with textile producers, amplifying pressure on the entire ecosystem. Indian textile manufacturers and fashion brands exporting to Europe face particular urgency as these regulations apply regardless of production location. Compliance represents market access condition—noncompliance means exclusion from the world’s most demanding consumer market.

The Business Case for Transparency

Financial analysis increasingly reveals compelling business cases for implementing traceable ethical textile supply chains despite implementation costs. Reduced supply chain risk improves resilience by identifying vulnerabilities before crises emerge. Production delays, facility closures, regulatory compliance failures, and labor disputes devastate unprepared supply chains; transparency systems enable anticipatory problem-solving. Companies like Patagonia have documented that sustainability investments correlate with improved brand reputation, stronger customer loyalty, and price premiums enabling higher profitability than competitors relying on cost minimization.

Consumer willingness to pay premiums for verified sustainable products creates direct revenue opportunities. Nielsen research showing 66% of global shoppers willing to pay more for sustainable products reflects genuine market demand. Brands successfully communicating transparent supply chains capture disproportionate market share among conscious consumers while building resilience against future regulatory tightening.

Digital efficiency gains from implementing transparency systems generate operational savings. Real-time supply chain visibility reduces inventory carrying costs, improves demand forecasting accuracy, and minimizes waste from production misalignment. Automated data collection through IoT sensors and blockchain integration reduces audit expenses by eliminating redundant manual verification. Mid-sized textile producers implementing traceability platforms report productivity improvements exceeding 15% within implementation’s first two years.

Looking Toward Integrated Industry Transformation

The trajectory toward ubiquitous traceable ethical textile supply chains appears inevitable given regulatory momentum, consumer demand, technological capability, and competitive dynamics. Industry leaders recognize that transparency transforms from optional value-add to foundational requirement. This realization drives investments in standardized platforms, worker education, and supply chain partnership development that accelerate transformation across tiers.

Future evolution likely encompasses several developments. AI-powered supply chain monitoring will shift from reactive compliance verification toward predictive risk management, identifying potential ethical or environmental problems before they occur. Molecular traceability embedding unique identifiers directly in fibers will become standard, making adulteration essentially impossible. Digital Product Passports will evolve from static records into dynamic documents tracking product histories through secondary markets, rental platforms, and recycling pathways supporting circular economy principles.

Regional supply chain specialization will continue developing as brands balance cost efficiency against transparency requirements. Shorter supply chains localized within regions will gain competitive advantage over far-flung global networks despite historical cost advantages. Labor rates may rise in core production countries as transparency forces accounting for true worker costs, but productivity improvements and reduced fraud will offset increases. Emerging textile-producing nations that invest early in traceability infrastructure will establish competitive advantage as regulatory requirements tighten globally.

Consumer engagement with supply chain transparency will deepen as accessibility improves. QR code scanning revealing garment histories will become routine, and consumers will make purchasing decisions based on transparent supply chain information much as they currently evaluate nutritional information on food products. This consumer participation creates powerful accountability mechanisms—products from questionable supply chains will face immediate market rejection while verified ethical products command loyalty and premium prices.

The textile industry’s transformation toward universally traceable and ethical supply chains represents not merely sustainability improvement but fundamental reimagining of how global production networks operate. By making visible what was previously hidden, transparency creates accountability mechanisms aligning individual incentives with collective interests. Workers benefit from verifiable fair labor protections, communities gain environmental protections from visible chemical and waste impacts, brands build genuine consumer trust through authentic sustainability commitments, and investors gain confidence in long-term company viability. This alignment of interests suggests that traceable ethical textile supply chains will not remain merely emerging industry norm but will become baseline expectation defining competitive success in textile and apparel manufacturing.